The pharmaceutical industry achieved 39 approvals in 2012 – the highest number for several years – triggering a much-needed wave of optimism. But sadly approval is not a guarantee of either patient benefit or commercial success. So DrugBaron looked a little deeper at the drugs behind the headline numbers.

For a start, only 35 of the 39 were drugs (two imaging agents were approved, together with a laxative for colonic imaging and a surfactant for pre-term infant lungs), and of the 35 only 15 targeted new mechanisms of action, with the rest offering, for the most part, minor benefits over already-approved therapeutic options.

Seven of the approved drugs offer treatment for conditions where there was no real previous options – and therefore represent unambiguous and significant patient benefit. Most strikingly, though, five of these seven were in indications that are not just orphan but ultra-tiny. Indeed, in the case of Raxibacumab, the antibody against anthrax toxin from Human Genome Sciences, the patient population might be zero in the absence of an outbreak of biological warfare. Of the seven drugs for previously untreatable indications, only Arena’a anti-obesity drug Belviq and Fulyzaq from Salix, a drug to treat GI complications of HIV, have the potential to treat more than a few thousand patients.

The 2012 approvals were a massive wake up call for the industry – the question is, was anyone listening?

The eight drugs bringing new mechanism of action to a disease where treatment options already exist also have the potential to deliver real advances. Some will: Pfizer’s jak inhibitor Xeljans will find a place in the treatment paradigm for rheumatoid arthritis, and the unheralded beta3 adrenoceptor antagonist Myrbetriq from Astellas will bring relief to the many with overactive bladder that is poorly controlled by existing alpha blockers. But others, most notably the Factor Xa inhibitor Eliquis from BMS offers little or no advantage over the generic standard of care.

Of the remainder, some fifteen (more than a third of the total approvals) are oncology drugs, mostly more kinase inhibitors, many on accelerated approvals where patient benefit remains to determined. Even those with a full dataset to support approval deliver only a month or two benefit on overall survival, and it has to be questioned whether they really offer sufficient value to justify their use at all (although among the oncology approvals the prospects for Xtandi in prostate cancer may be rosier).

Looking at sales projections, how many blockbusters are there here? DrugBaron projects peak sales over $1billion a year for Stribild, which is likely to become first line for HIV, and perhaps for Xeljans and maybe even Linzess (an exciting drug for constipation-predominant IBS). Of the rest, perhaps seven will achieve peak sales over $200M a year, but at least fifteen will do well to reach $50M.

Academic laboratories, small biotech and global pharma companies contributed almost equal proportions of the real discovery

Most strikingly, the biggest sellers will canabalize existing premium products (Stribild and Xeljans will only gain market share at the expense of currently approved products – which may be good for their respective owners, particularly if Pfizer grabs a share of the current spend on anti-TNFs) but doesn’t really represent a return on R&D for the industry as a whole. None of the drugs approved in 2012 will win back a significant share from generics – the biggest hope for that must have been Eliquis, but the clinical data was disappointing: enough to approve it but hardly enough to justify a premium over generic warfarin.

So the elephant in the room remains firmly enthroned. With global R&D spend on therapeutics now well in excess of $40billion a year, this motley collection of approvals, more numerous than in past years though they are, do not represent good value for money as a return on that capital investment.

The surprise is not how many approvals there were altogether, but how few there were from the global players

The “excuse” such as it is remains the same. The current crop of drugs represents the product of investment in the past. We are better now, claim the optimists, and the product from the 2012 R&D spend will be much more impressive. It may be true, but the evidence is not yet visible on the horizon. Quantity does not substitute for quality, and the class of 2012 do little to inspire belief that the industry has learned the lesson of the early 2000’s: incremental innovation, with approvable “me too” or even “me better” drugs, is never going to sustain the current level of investment. Unless we raise the bar, and kill projects that are approvable (even, on their own, financially viable) and instead only develop real advances in patient care, the return on capital invested will continue to disappoint.

What else can we learn from a deeper examination of the 2012 approvals?

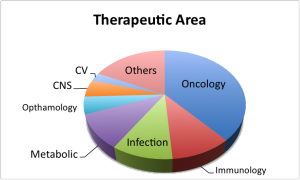

Two of the most important trends of the last decade seem to have gone in different directions: from a therapeutic area standpoint, the dominance of oncology (and related indications, such as actinic keratosis) has strengthened. Some fifteen of the approvals were in the broad oncology space, a healthy lead over metabolic diseases (four), inflammation and immunology (four) and infectious diseases (four).

But the recent increases in approvals for monoclonal antibodies has reversed. Only two monoclonal antibodies were approved in 2012, and one of those (raxibacumab for anthrax) is unlikely to see much use in the clinic. Considering the share of R&D spend that antibody therapeutics have attracted in the last decade, more might have been expected.

Biologicals as whole, by contrast, have done well: nine of the approvals were for biologicals (and another two for natural products) although the majority were biosimilars by any other name. The FDA was at pains in its press release to point out that Tbo-filgrastim from Sicor was not biosimilar Neupogen, but an entirely new BLA. Indeed it is, but from a clinical and commercial standpoint, it offers little to differentiate it from the incumbent product. Elelyo taliglucerase from Proteolix and Pfizer may offer a more obvious advantage over the Genzyme/Sanofi equivalent (not least in terms of availability) but the fact remains that it only does the same job in the clinic.

Another well-recognized trend has continued: the dominance of drugs developed in the USA in the list of FDA approvals. At least 28 of the 39 approvals had the majority of their development carried out in the USA. As the FDA is the US regulatory body, such a dominance will surprise no-one, but it is interesting to look deeper at the source of the original inventions that underpinned each product. Again, the US win hands down: some 24 of the 35 or so products for which a single seminal invention could be identified originated in either a US company laboratory or a US academic institution. Japan trail in a distant second, with their labs responsible for five of the inventive steps. Depressingly for DrugBaron, as a UK scientist, precisely none of the 2012 approvals can trace their origins to invention in the UK and perhaps only six to Europe as a whole.

2012 is only one year. But European governments and policy makers cannot ignore the dearth of measurable output (even at the level of approvable drugs, which, as DrugBaron has already noted, mostly represent disappointingly small advances in real patient care). The argument that investment in life sciences should be an engine of growth falters unless we can point to the deliverables. Employment head counts may trump real outputs in short term political deliberations, but in the long term become a drag rather than a booster for our economy.

The solution is simple: availability of capital has long since ceased to be the limiting factor for successful drug development. Smart development capability is the rate-limiting step, and European policy makers need to stop focusing on size and worry much more about quality.

The biggest sellers among the 2012 approvals will canabalize existing premium products – none of them will win back a significant share from generics

The other interesting observation from the 2012 dataset is the predominance of agents invented in either biotech companies (as opposed to global pharma giants) or academic laboratories. Around fourteen of the products had their origins in academia, and another twelve or so came from (relatively) small product-focused biotech companies (more than half of which were actually taken to approval by those smaller companies). Only some thirteen of the products had their origins inside the gargantuan R&D operations of the global pharma companies.

Of course, any such analysis has a degree of subjectivity – many of the products had a number of “inventive steps”, and cant be attributed solely to one institution. But the importance of the US biotech sector in driving up approval rates cannot be over-estimated. Of course, some of these products may have been driven to approval but garner no sales – many of the biotech-derived cancer products on accelerated approvals will eventually fall into this category – but others represent real advantages for patients, and real commercial returns for their investors (Juxtapid from Aegerion, Kalydeco from Vertex and Linzess from Ironwood all fall into this category).

Perhaps, then, once again, the surprise is not how many approvals there were altogether, but how few there were from the global players.

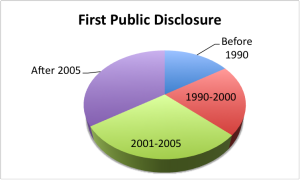

One parameter that stubbornly refuses to shift is the time taken for development. For the 2012 cohort, the median time from first public disclosure to approval was almost exactly ten years. In an accelerating world, drug development remains in the slow lane.

The elephant in the room remains firmly enthroned: this motley collection of approvals does not represent good value for money as a return on the global investment in pharmaceutical R&D

The overall picture from the class of 2012 is, then, much more of a curate’s egg than the headline figure of 39 approvals suggest. The landscape is one of effective drugs for (often very) small populations together with (often very) incremental improvements for existing medicines. Much like Windows 8, most of these “me better” drugs are hardly-superior versions of massive products, with a list of supposed improvements that fool few real customers.

The landscape is one of academic laboratories, small biotech companies and global pharma behemoths contributing almost equal proportions of the real discovery.

But without doubt the innovation landscape is dominated by the US. This is not a dominance that comes from incumbency – if there were better development candidates emerging elsewhere in the world, they would be snapped up and developed. The relative failure of the rest of the world does not result from American superiority. The 2012 approvals were a massive wake up call for the industry – the question is, was anyone listening?

The Cambridge Partnership is the only professional services company in the UK exclusively dedicated to supporting companies in the biotechnology industry. We specialize in providing a “one-stop shop” for accountancy, company secretarial, IP management and admin services. The Cambridge Partnership was founded in 2012 to fill a gap. Running a biotechnology company has little …